Let POS Finance help turn anxious shoppers into action shoppers

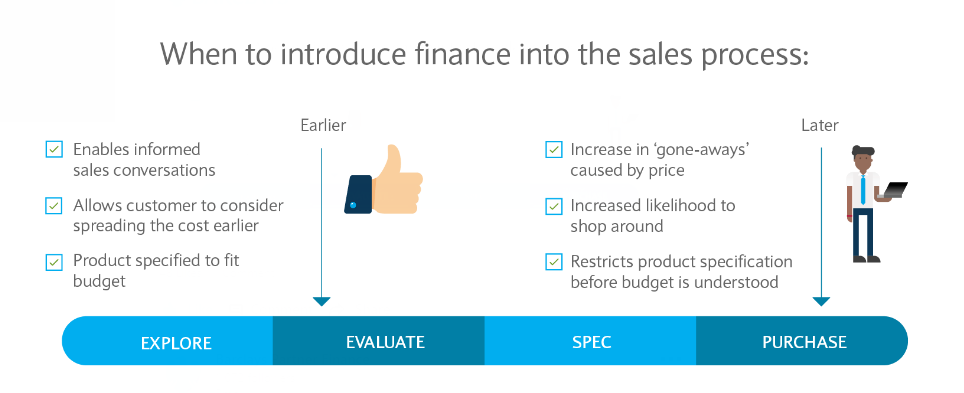

Waiting until your customer comes to pay to raise the subject of financing their purchase could mean they miss out on choosing the product they really want.

In fact, the earlier you can introduce finance into the purchase journey, the earlier your customers can understand what they can afford. This gives you the potential to attract new customers that may have otherwise been out of target market for your products.

Think about how your customers shop. Whether it’s scrolling on a smartphone during the commute or browsing desktop on a lunch break, most of us start our shopping for bigger-ticket items on a screen.

We shop around, hitting multiple sites to make sure we find the best product, with the most convenient delivery options, at the best price. It’s while conducting this research that your customers learn all they need to know about you as a brand. What if they spot that perfect purchase on your site, only to discover it is well out of their price range?

Knowing that you offer point of sale finance options empowers customers to make purchase decisions based on monthly budget rather than total price alone. Their new purchase can be specified to fit their budget and can help lead to increased basket size for retailers

What are the benefits? *

Point of sale finance is designed to make it easier for you to sell, and for your customers to buy.

Enables customers to spread the cost of purchases

Research suggests that when making a major purchase, many of us are more concerned with what we can afford on a monthly basis, rather than what we can afford overall. Our recent consumer survey highlighted the importance of convenience when making purchasing decisions; 47% of consumers said they preferred point-of-sale because they found it more convenient than other finance options, while 44% said it helps them with budgeting.

Makes products more affordable

While there probably aren’t many of us that would be able to pay for a new bathroom or a dream kitchen without a second thought using the money in our current account, many of us would be happy to pay for that same purchase if we could opt for smaller, manageable monthly payments. 83% of consumers said that purchasing with point-of-sale finance not only made their product more affordable; it actually meant they were able to spend more overall.

Increases the average value of purchases

Many consumers view point-of-sale finance as a payment option that can make larger purchases more affordable. 54% of consumers said they wouldn’t have been able to make the same purchase had point-of-sale finance not been available.

Reduces risk of customers going to competitors

Not being able to make a purchase outright doesn’t mean that your customers will just give up on buying the product they have had their eye on. 27% of consumers we asked said that if point-of-sale finance hadn’t been available, they would likely have gone to another store where it was.

Get your deal seen

All Barclays Partner Finance clients have access to a wide range of point-of-sale assets for use both in-store and online to help introduce finance offers to customers and pique their interest from the very beginning.

If you are an existing Barclays Partner Finance client, please ask your account manager for more details.

*Source: Perceptions and Experiences of Using Finance. A survey of 1026 conducted by Barclays Partner Finance, September 2018

Get in touch

To discuss your business requirements and how Barclays can support you, contact us today.